[ad_1]

I was thinking about this, as people were remarking on how the 30 year bond was rising.

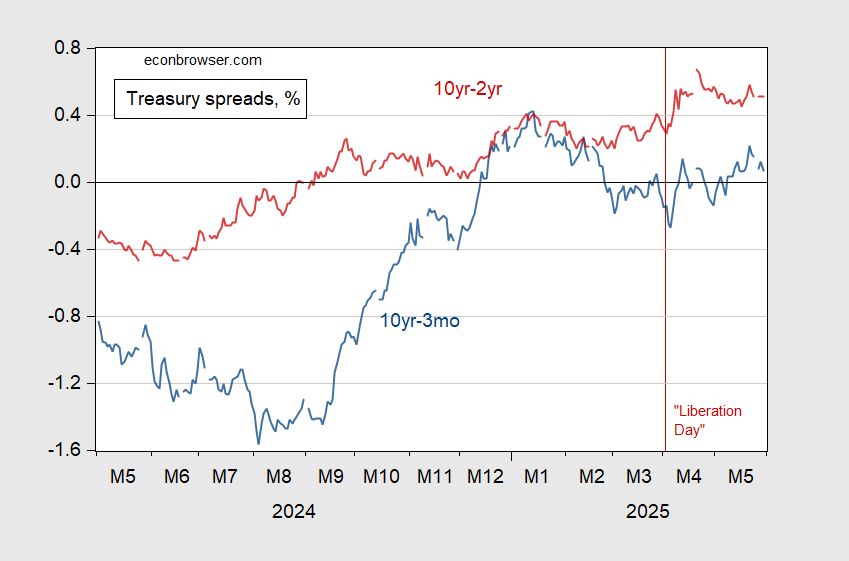

First, let’s think of how the long term yield is thought of, in a world where there is no sovereign risk (as in the case where the US government bond yield is risk free).

The term premium is then the risk due to changes in inflation and short term interest rates.

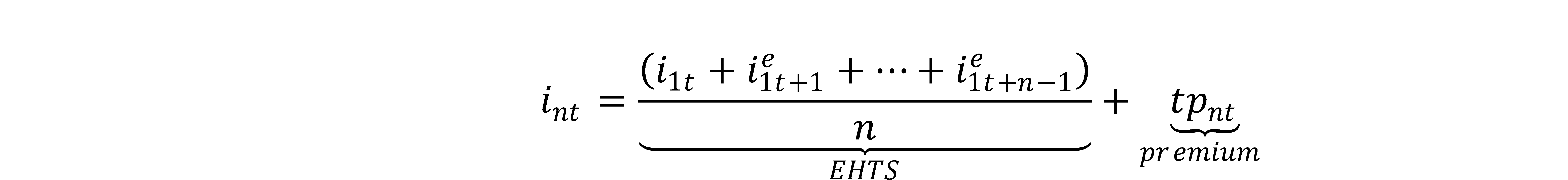

However, in a world where there is default risk:

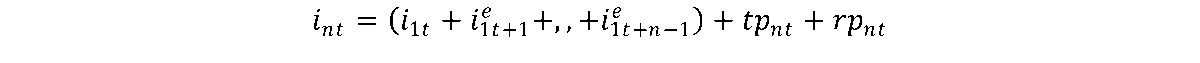

If the rp (default risk) term is now significantly large and variable, then increases in the term spread, or steepening of the yield curve, might mean something different than it did before. Do we have a pure measure of default risk? No, but we have CDS swaps for US government bonds at different maturities. Here’s the picture for ten year yields and ten year spreads.

Figure 1: Top panel, 10 year CDS spread, Middle panel, 10 year Treasury yield, % (blue), Bottom panel, nominal dollar index, 2006=100 (blue). Red line at April 2, 2025 Source: worldgovernmentbonds.com, Treasury via FRED.

The fact that the dollar value collapses as the interest rate rises is consistent with the proposition that there is now some sort of significant credit risk; the rising CDS spread combined with falling dollar argues against the fear of monetization (and subsequently higher inflation) as the reason for a depreciating currency.

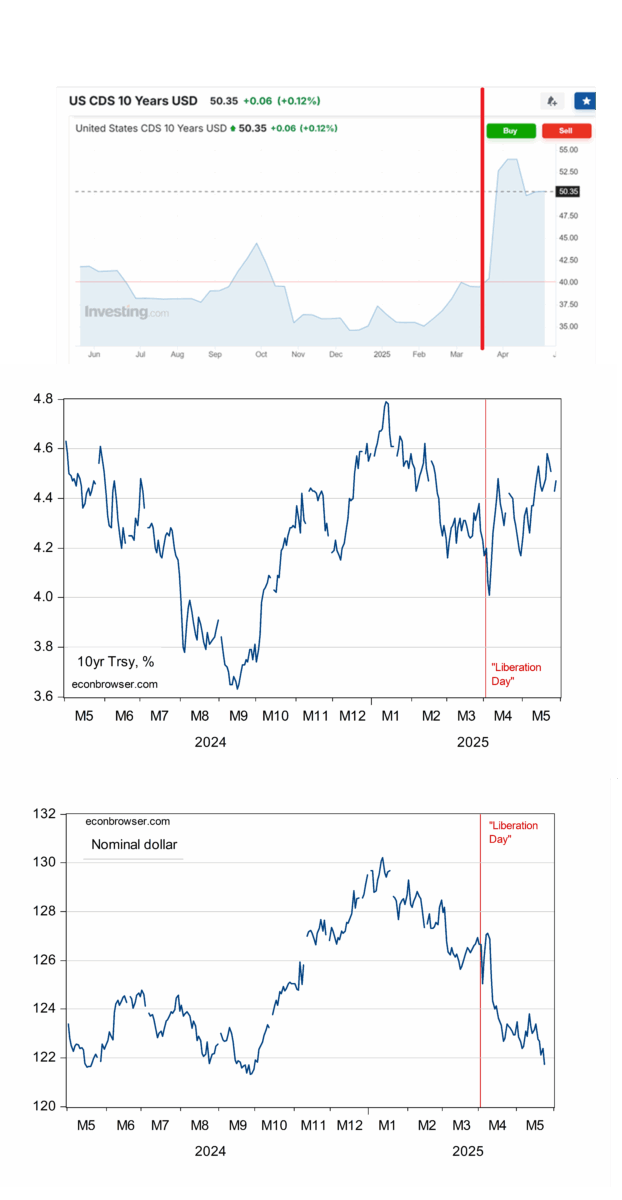

Hence, if there were no default risk, the spreads would probably be less positive (more negative). How much is hard to say. However, this reasoning would suggest that the previous correlation between recessions and spreads would be even less robust than usual.

Figure 2: 10yr-3mo Treasury spread (blue), 10yr-2yr Treasury spread (red), both in %. Source: Treasury via FRED and author’s calculations.

[ad_2]

Source link