This week’s livestream featuring Menzie Chinn and Lydia Cox, moderated by Mike Knetter, is Tuesday, Aug. 5, at 7 p.m. CDT (hosted by the Wisconsin Alumni Association):

Register here.

In the first half of the year, the Trump administration has reshaped many aspects of economic policy, often in ways that are at odds with the views of outside economists. As Trump’s economic agenda takes shape, many are wondering about its impact. How are tariffs affecting prices for consumers? Are the biggest impacts behind us or yet to come? How will the new federal budget affect the deficit? Will the administration exert more pressure on the Federal Reserve and its chair? And what does this all mean for the average American?

My pictorial assessment:

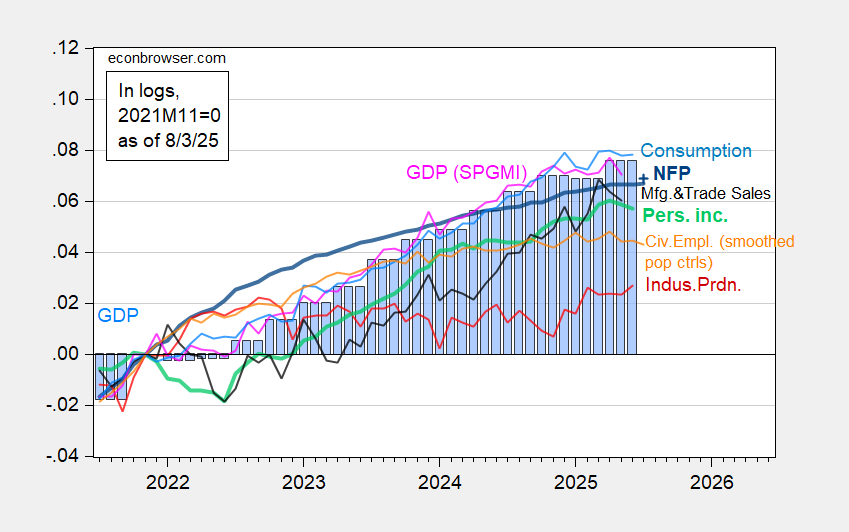

Figure 1: Nonfarm Payroll from CES (bold blue), implied NFP Bloomberg consensus as of 7/1 (blue +), civilian employment with smoothed population controls (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2025Q2 advance release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/1/2025 release), and author’s calculations.

The labor market really does look like it’s slowing down…

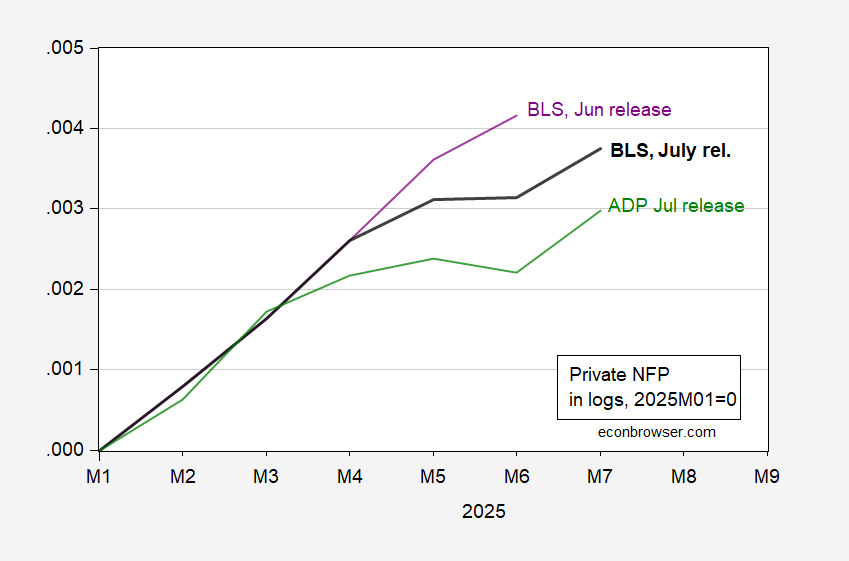

Figure 2: Private nonfarm payroll employment, July release (bold black), Jun release (purple), ADP July release (green), all s.a., in logs, 2025M01=0. Source: BLS, ADP via FRED, and author’s calculations.