The Economist asks the question, and says — in part — yes.

Rebalancing the global economy is Donald Trump’s defining cause. China should produce less and consume more, the president thinks; meanwhile, America should produce more by reindustrialising. There is a final logical step to this equation: America should also consume less.

Such abstemiousness is unavoidable if MAGA-maths is to add up, as even the administration admits. Scott Bessent, the treasury secretary, calls for “less consumption”; more floridly, Mr Trump says his trade war might result in children having “two dolls instead of 30”. As J.D. Vance, the vice-president, puts it: “A million cheap, knock-off toasters aren’t worth the price of a single American manufacturing job.”

The article cites Hubbard, Navarro (back before “Death by China”), Bernanke, Obstfeld, Gagnon, and yours truly. On the latter:

Mr Chinn estimates that a reduction of a percentage point in the budget deficit would cut the current-account deficit by about half a percentage point. For his part, Mr Obstfeld is blunt about the alternative to a fiscal rebalancing: “If the government keeps borrowing the way it is, it is quite unlikely that we will ever achieve a trade surplus.”

Several potential paths to smaller budget deficits would have the additional benefit of encouraging consumers to save. For instance, if the government reformed health-insurance and pension programmes to make them less generous as the population ages, it would be rational for households to save more themselves. The government could also implement a well-designed consumption tax at the national level (the complete absence of such a levy makes America unusual). Unfortunately, the political reality is that no fiscal consolidation is in the offing. Mr Trump’s tax bill, which is making its way through Congress, will prolong enormous deficits.

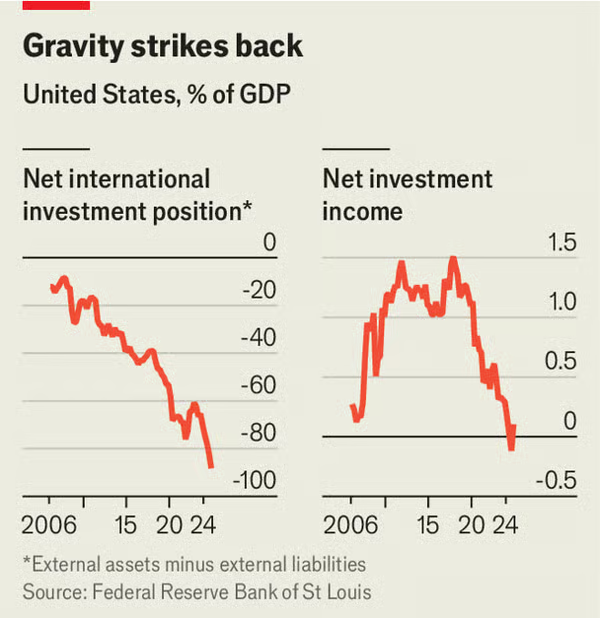

Here’s the graph from the article:

Source: Economist.

This point does not mean that one should go straight to government spending cuts. Rather, higher tax rates, increased saving in pension programs would, smaller budget deficits could all go far in stabilizing debt-to-GDP, and net external liabilities-to-GDP. I think that is likely to be a lot less painful than destroying American exorbitant privilege by way of making global investors worry about default on US Treasurys.

By the way, the 0.5 coefficient comes from my work with Hiro Ito, Barry Eichengreen and Eswar Prasad; most recently Chinn and Ito (JIMF, 2025), and Chinn and Ito (2021) for instance.