[ad_1]

Many credit cards offer monthly, quarterly or annual statement credits after you spend with select merchants — but it’s not always clear how long it takes for those credits to post.

While banks often say it can take up to two or three months, most credits arrive much sooner.

We polled TPG staff members and readers to find out just how long it really takes. Here’s what we found for cards from American Express, Capital One, Chase and Citi.

How long does it take to receive Amex statement credits?

American Express statement credits tend to post within two to three days on average, though it varies depending on the specific card and statement credit. Enrollment is required in advance for select benefits; terms apply.

Amex Business Gold

To learn more, read our full review of the American Express® Business Gold Card.

Amex Business Platinum

To learn more, read our full review of The Business Platinum Card® from American Express.

Amex Gold

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

To learn more, read our full review of the American Express® Gold Card.

Amex Green

To learn more, read our full review of the American Express® Green Card.

The information for the Amex Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex Platinum

To learn more, read our full review of The Platinum Card® from American Express.

Delta SkyMiles cards

To learn more, check out our full list of Delta SkyMiles cards.

Hilton Aspire

To learn more, read our full review of the Hilton Honors American Express Aspire Card.

The information for the Hilton Aspire card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Hilton Surpass and Business

To learn more, read our full review of the Hilton Honors American Express Surpass® Card and our full review of the Hilton Honors American Express Business Card.

Marriott Bonvoy Brilliant

- Monthly dining credit: Three days

To learn more, read our full review of the Marriott Bonvoy Brilliant® American Express® Card.

How long does it take to receive Capital One statement credits?

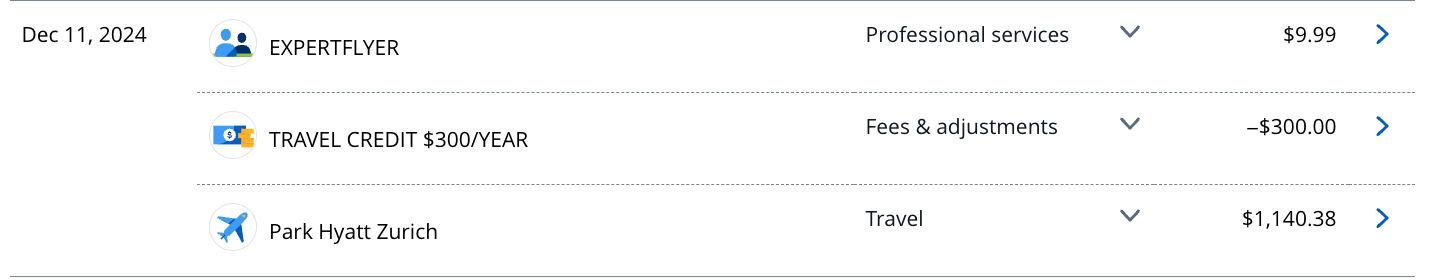

Venture X and Venture X Business

Both the Capital One Venture X Rewards Credit Card and Capital One Venture X Business come with an annual $300 travel credit for bookings made with Capital One Travel.

To learn more, read our full reviews of the Venture X and the Venture X Business.

How long does it take to receive Chase statement credits?

A few Chase-issued credit cards offer statement credits, so if you’re a cardholder, be sure to use the following.

Chase Sapphire Preferred

To learn more, read our full review of the Chase Sapphire Preferred® Card .

Chase Sapphire Reserve

The Chase Sapphire Reserve® (see rates and fees) has a broad travel category in terms of what you earn bonus points on and what counts for the card’s annual travel credit.

To learn more, read our full review of the Chase Sapphire Reserve.

United credit cards

- Renowned Hotels and Resorts credit: Two days

- Ride-hailing service credit: Two days

- United Hotels credit: Three days

To learn more, read our guide to United credit cards.

World of Hyatt Business Credit Card

To learn more, read our full review of the World of Hyatt Business Credit Card.

How long does it take to receive Citi statement credits?

Citi / AAdvantage Executive

The Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) is American Airlines’ premium travel card.

To learn more, read our full review of the Citi / AAdvantage Executive.

Bottom line

Maximizing your card’s perks is essential. These benefits unlock the card’s value and can offset the annual fee you pay to keep the card year after year. However, banks typically don’t make it clear how long it takes to receive your statement credits.

If you’ve been waiting longer than the average on this page, contact your credit card issuer to inquire about missing statement credits. The quickest and most effective way is to use your bank’s online chat or secure messaging function.

Related: The best credit cards, according to TPG spokesperson Clint Henderson

[ad_2]

Source link