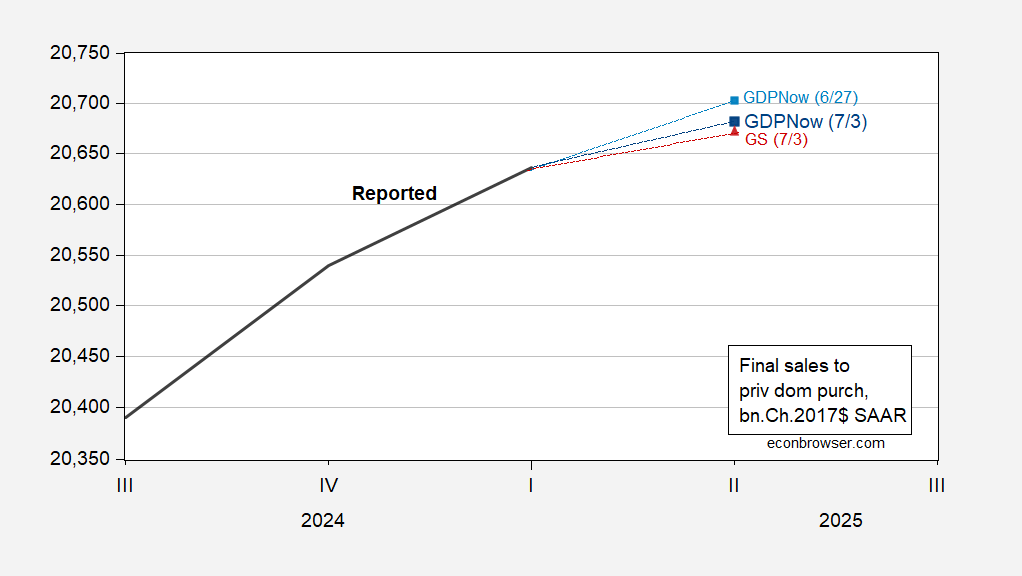

Atlanta Fed downgrades Q2 (GS ups from 0):

Figure 1: Final sales to private domestic purchasers (bold black), GDPNow of 6/27 (light blue square), of 7/3 (dark blue square), Goldman Sachs of 7/3 (red triangle), all in bn.Ch.2017$ SAAR. Source: BEA, Atlanta Fed, Goldman Sachs, and author’s calculations.

If final sales to domestic private purchasers (termed “core GDP by Furman) is a better measure of aggregate demand, then it sure likes deceleration. Combined with deceleration in monthly indicators followed by the NBER’s BCDC, it seems like a slowdown is in the offing.