The Conference Board today:

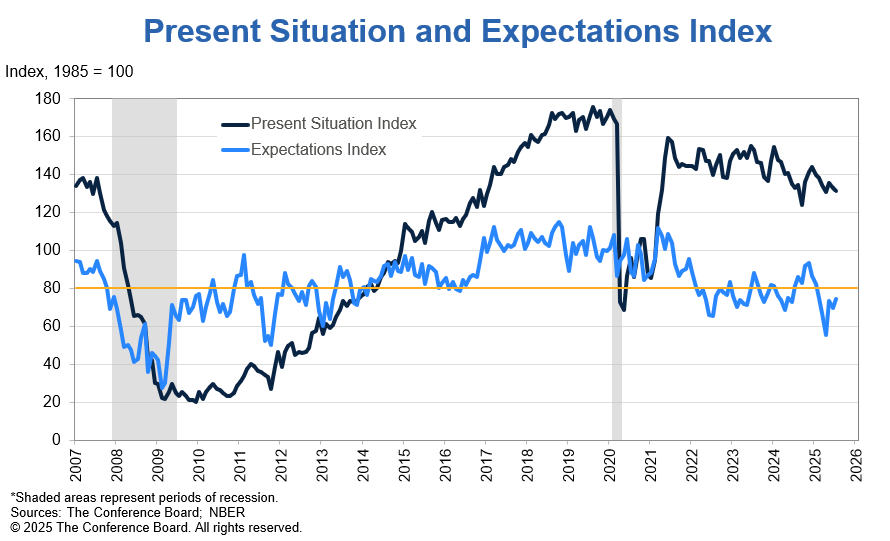

The Conference Board Consumer Confidence Index® improved by 2.0 points in July to 97.2 (1985=100), from 95.2 in June (revised up by 2.2 points). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—fell 1.5 points to 131.5. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—rose 4.5 points to 74.4. But expectations remained below the threshold of 80 that typically signals a recession ahead for the sixth consecutive month. The cutoff date for preliminary results was July 20, 2025.

“Consumer confidence has stabilized since May, rebounding from April’s plunge, but remains below last year’s heady levels,”

…

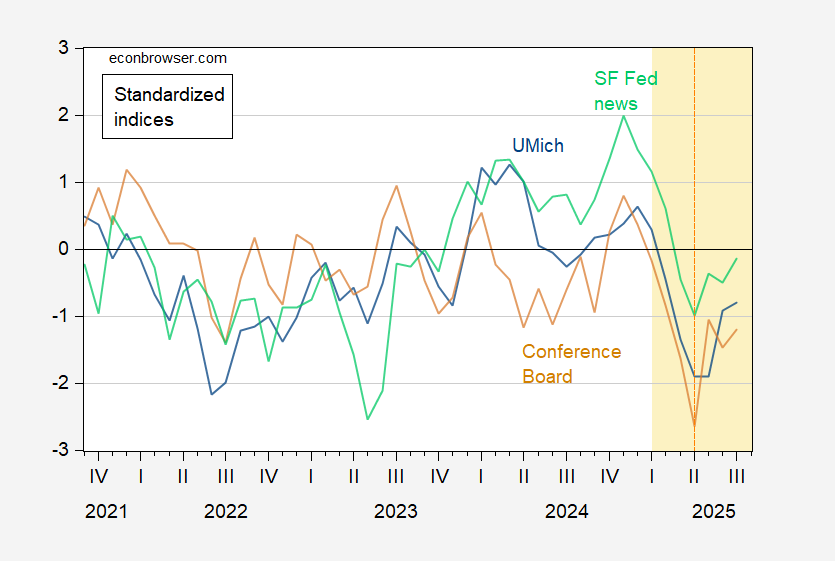

Figure 1 shows the Conference Board’s measure vs. the MIchigan measure, and a text based news sentiment index.

Figure 1: University of Michigan Consumer Sentiment (blue), Conference Board Consumer Confidence (tan), and Shapiro, Sudhof and Wilson (2020) SF Daily News Sentiment Index (light green) , all demeaned and normalized by standard deviation (for the 2021-2025M02 sample period); and Shapiro, Sudhof and Wilson (2020) SF Daily News Sentiment Index (black, right scale). The News Index observation for July is through 7/27/2025. Orange shading denotes Trump 2.0 administration. Orange dashed line at “Liberation Day” in 2025M04. Source: U.Mich via FRED, Conference Board via Investing.com, SF Fed, and author’s calculations.

The Conference Board measure is TWO standard deviations lower than November 2024, and ONE standard deviation below January 2025.

Note the distinction between current conditions vs. expected.

Source: Conference Board, accessed 7/29/2025.

As CB observes, the expectations measure remains below the recession threshold.

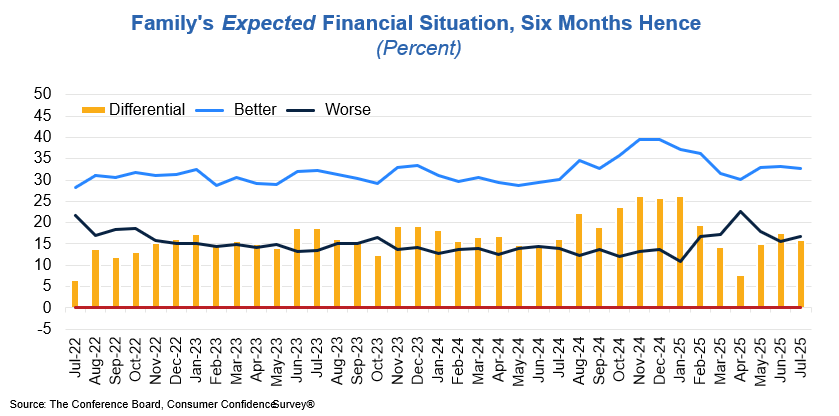

Finally, as for individual households’ views regarding their own expected situation in the future, this figure is relevant.

Source: Conference Board, accessed 7/29/2025.

While the “better”-“worse” differential has shifted to slightly more positive relative the nadir in April, it is substantially below the January 2025 high point.