[ad_1]

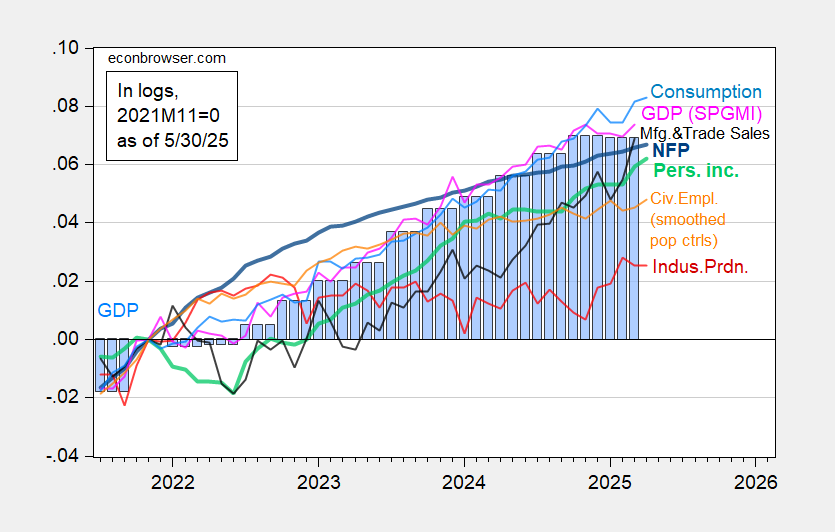

Consumption level is revised downward, while personal income ex transfers continues to rise. Manufacturing and trade sales rise in March. First is a picture of key variables followed by the NBER’s BCDC:

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), civilian employment using smoothed population controls (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. 2025Q1 GDP is advance release. Source: BLS via FRED, Federal Reserve, BEA, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (5/1/2025 release), and author’s calculations.

Excepting official GDP (which due to trade-related distortions should be downweighted) and industrial production, most measures suggest continued growth through April (for May, see high frequency indicators discussed here).

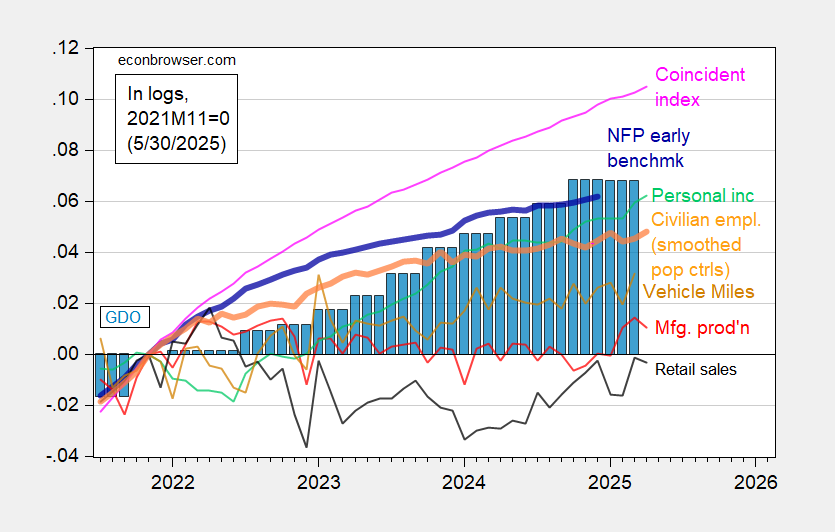

Alternative indicators also suggest continued expansion through April.

Figure 2: Preliminary Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment with smoothed population controls (bold orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), real retail sales (black), vehicle miles traveled (tan), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve via FRED, BEA 2025Q1 secondi release, and author’s calculations.

[ad_2]

Source link