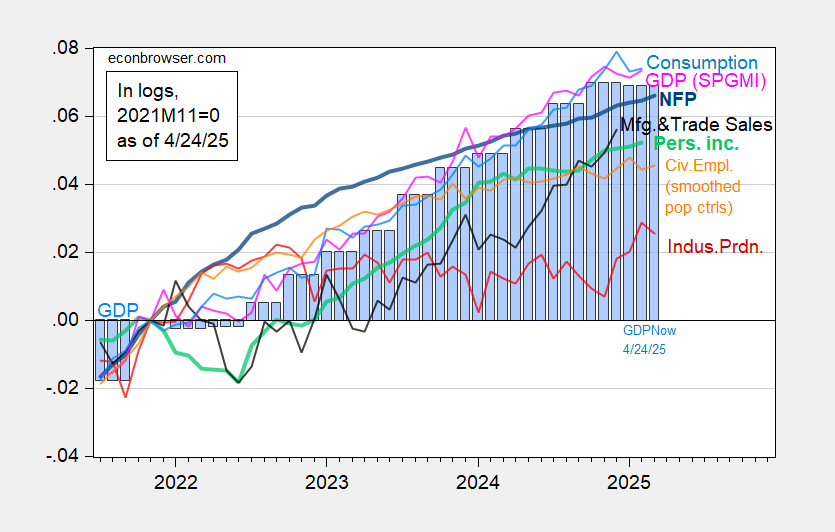

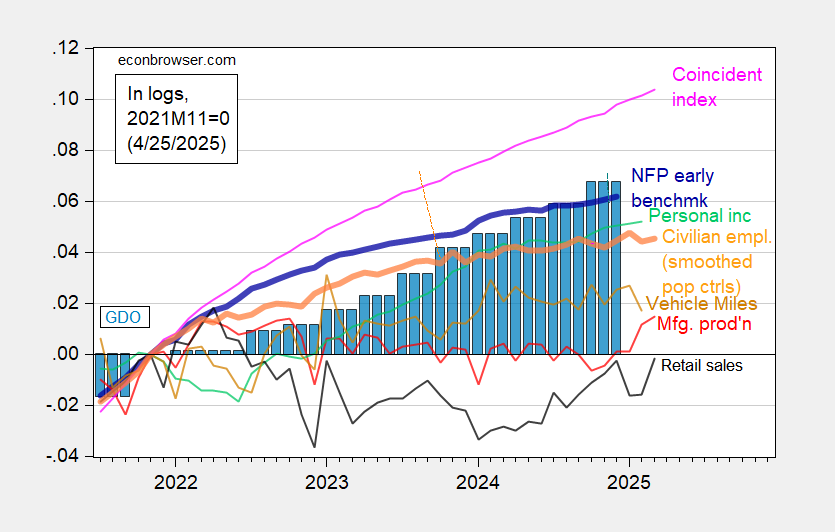

A reader asks me about my 2025H1 recession call. I don’t have one, but here’s the latest depiction of indicators followed by the NBER Business Cycle Dating Committee, as well as alternatives. Only consumption and vehicle miles traveled (and heavy truck sales) seem indicative of recession (maybe GDP using GDPNow).

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), implied NFP from preliminary benchmark through December (thin blue), civilian employment as reported (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. 2025Q1 GDP is GDPNow as of 424/2025. Source: BLS via FRED, Federal Reserve, BEA 2024Q4 3rd release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (4/1/2025 release), and author’s calculations.

Figure 2: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted smoothed population controls (bold orange), manufacturing production (red), personal income excluding current transfers in Ch.2017$ (bold green), real retail sales (black), vehicle miles traveled (tan), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve via FRED, BEA 2024Q4 3rd release, and author’s calculations.

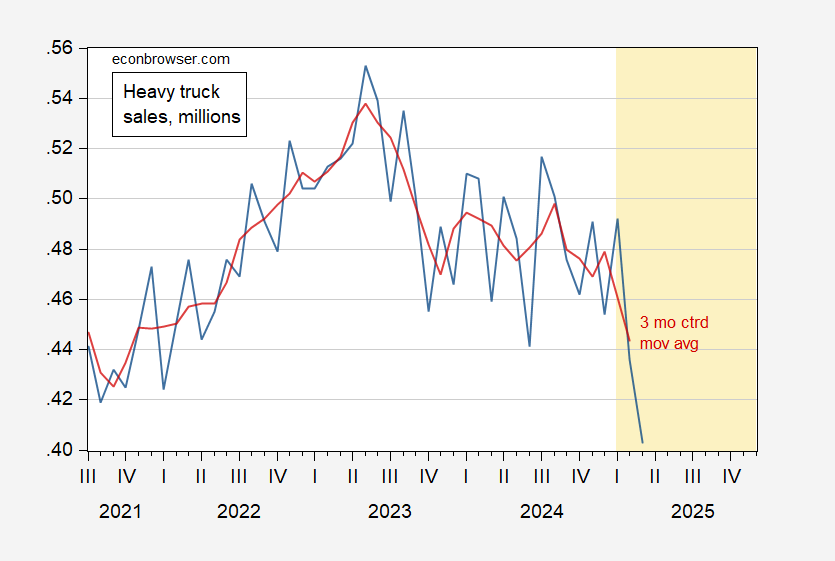

One interesting indicator of how uncertainty has paralyzed investment is this picture of heavy truck sales:

Figure 3: Heavy truck sales, millions of units s.a. (blue), 3 month centered moving average (red). Source: BEA via FRED, and author’s calculations.