Source: NYT, July 6, 2025.

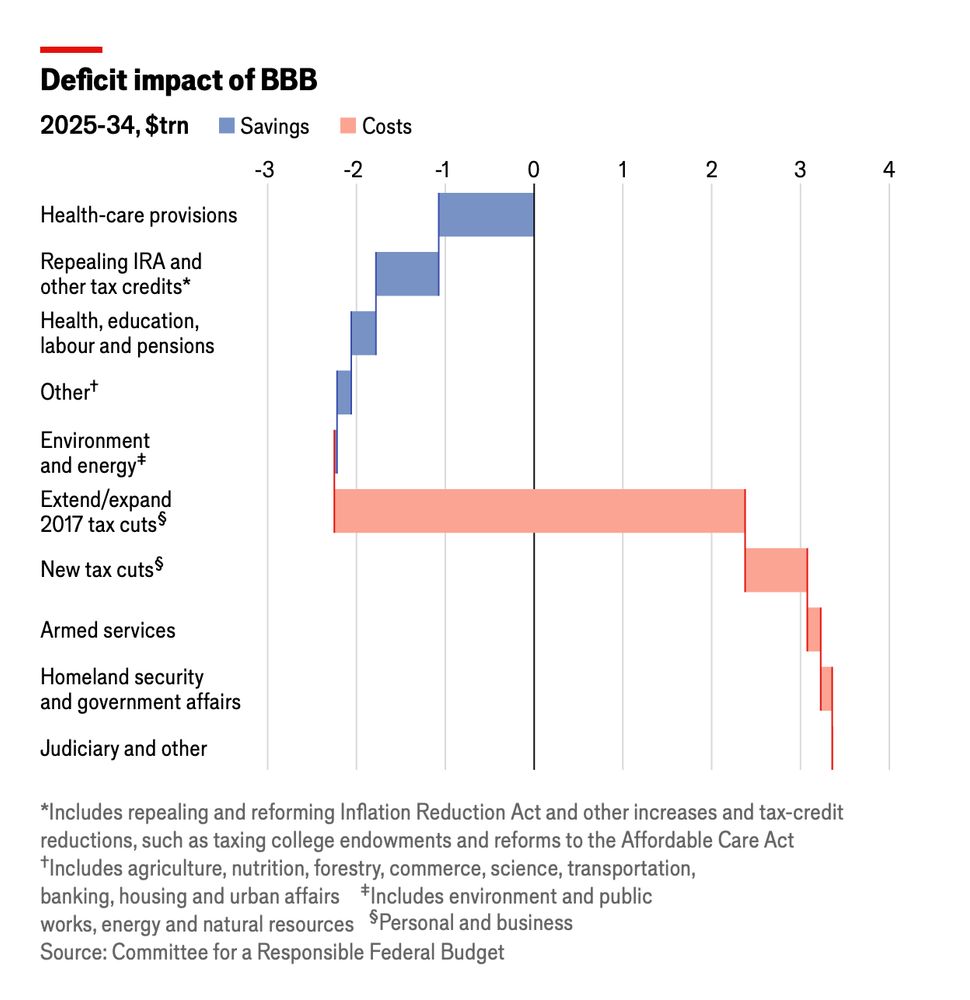

The OBBB alters the path of deficits relative to current law by a substantial amount, but not too much relative to current policy. However, the composition of overall spending and taxes is altered considerably relative to both current law and current policy. Relative to current law:

Source: G. Elliott Morris.

So the tax cuts are expanded — as are expenditures for Homeland Security (think ICE), as expenditures for the social safety net are reduced. If you’ve never worried about losing your health care, this won’t mean much to you…but it will mean a lot to both lower income and working middle class households.

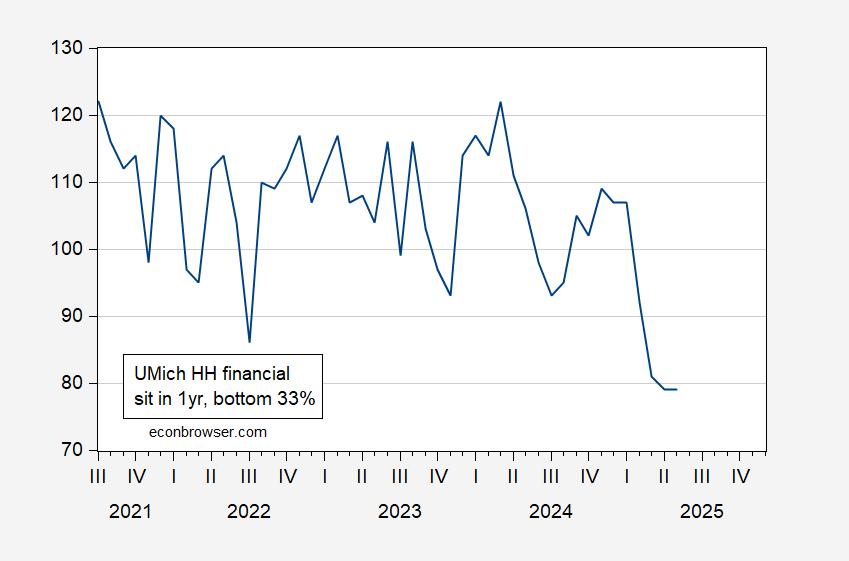

Hence, while on pure fiscal expenditure terms (one can think of transfers and taxes as inverses of each in a simple Keynesian aggregate demand context), one might think of OBBB as broadly neutral relative to current policy in the short term (cuts and tax increases are back loaded past the midterms), I’d say they will raise uncertainty and anxiety a lot for a certain portion of households. The rational response will be to cut consumption. The lowest 33% of the income distribution is already feeling pretty gloomy.

Figure 1: Expected financial situation in 1 year, bottom 3rd income distribution (blue). Source: University of Michigan Survey of Consumers.

When the hospitals start closing and Medicaid funding falls (along with Medicare, given Paygo rules), one can guess what will happen. This combined with regressive taxes (called tariffs) and it’s hard to see GDP growing rapidly in the next year, despite NEC Director Hassett’s forecast (Fox):

“You’re looking at 4 percent growth, which I think is an upside that is completely possible.”