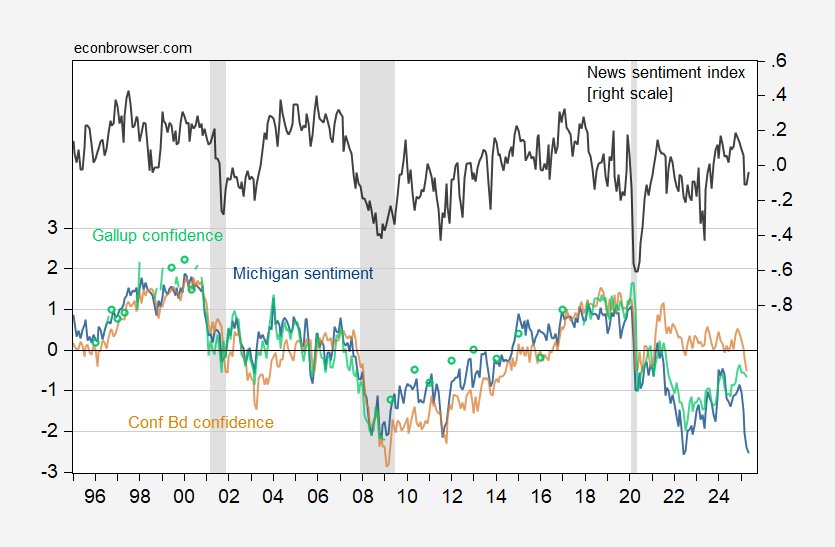

Note slight recovery in news sentiment (thru 5/18). Probably reflects some relief at the pause in higher US tariffs on Chinese goods.

Figure 1: University of Michigan Consumer Sentiment (blue, left scale), Conference Board Consumer Confidence (tan, left scale), Gallup Economic Confidence (light green, left scale), all demeaned and normalized by standard deviation (for the 1995-2024 sample period); and Shapiro, Sudhof and Wilson (2020) SF Daily News Sentiment Index (black, right scale). The U.Mich sentiment index for May is preliminary. The News Index observation for May is through 5/18/2025. NBER defined peak-to-trough recession dates shaded gray. Source: U.Mich via FRED, Conference Board via Investing.com, Gallup, SF Fed, NBER, and author’s calculations.